Quick Summary

This blog talks about how in-app wallets in ride-hailing software provide a simplified single-click payment method that brings convenience for your customers along with incentives, transparency and enhanced security. You will also explore the comparison between with and without an in-app wallet. And how you can retain more customers and get a competitive edge.

Ever booked a ride and hesitated at the payment screen by thinking cash or card? Wallet or UPI? If so, you’re not alone.

Passengers expect flexibility at every step, especially when it comes to paying for their rides.

That’s why ride-hailing apps have a taxi payment wallet that offers more payment options than ever before.

But here’s the big question, does all this variety make things smoother for passengers, or is it adding unnecessary complexity?

In this blog, we will explore what payment problems taxi businesses face, what is the role of taxi wallet applications in ride-hailing, and compare ride-hailing with and without a taxi app wallet. Also, we will shed light on the benefits of Yelowsoft’s taxi payments app.

The payment problem faced by taxi businesses

Accepting payment should be easy, not another hassle for your business. Yet most rideshare operators face payment problems. Check out below the substantial drawbacks you may be facing with traditional payment options. Plus, the revenue leakage and poor customer experience.

Drawbacks of cash and credit cards

Dealing with paper money and credit/debit cards costs your ride-hailing business valuable time and money. Your drivers lose productivity by doing all that they are not supposed to do - managing payments, accounting, matching receipts, and more.

The credit card fees alone erase your 2-4% of revenues or even worse. The bottom line is, that your drivers lose productivity and you lose new trips, profit, and loyalty.

Revenue leakage and reconciliation headaches

Without an integrated taxi payment wallet, it becomes confusing for you to match cash and card transactions for each ride. This inability results in an easy slip of funds which means a revenue leak.

You then think of: Where has your profit gone? Why the amount is not matching? Why the earning is less? And more.

Poor customer experience hurts retention/growth

Your passengers hate payment hassles. If you do not have a simple payment option in your phone app and your customers have to dig in for a card or exact change, it will result in poor customer experience.

Your customers will switch to the service provider and will find your alternative when they get a bad experience in paying.

Read More: Factors affecting driver behavior in the ride-hailing business

What is a taxi wallet application?

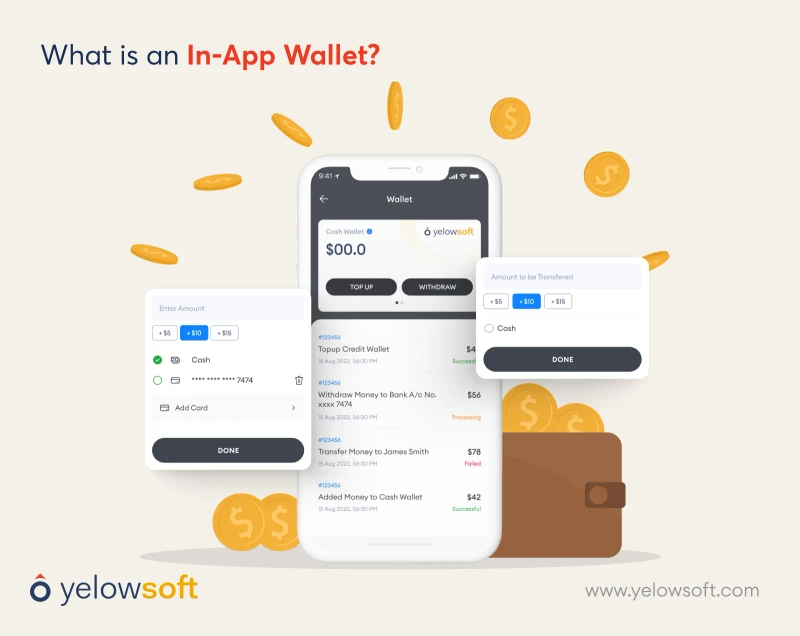

A taxi wallet application or we can also say an in-app wallet is a type of digital wallet for taxi apps that is built directly into a mobile app with the aim of making digital payment even easier. It allows users to easily store payment methods and make purchases without leaving the app to make it more convenient for them.

With ride-hailing apps specifically, an in-app wallet is an inbuilt payment feature that allows your passengers to securely link a payment method like a credit/debit card, mobile wallet, or bank account. The user doesn't have to enter their payment details each time they take a trip.

The passenger can use this stored payment source for a seamless one-click payment experience within the ride-hailing app for all trips and transactions.

Make all your transactions more flawless than ever with Yelowsoft

Role of taxi app wallet in ride-hailing

Ride-hailing is now powered by the push of a button. And payments make that possible via seamless in-app wallet integration. Let's examine the multifaceted role in-app payments play below.

Convenience and seamless payments

In-app wallets help you streamline your payment processes. It also plays a vital role in eliminating the need for handling physical cash. Furthermore, it allows you to enhance your user experience by offering a simple one-click payment option.

For example, by simply topping up the taxi digital wallet app, your passengers can conveniently pay for the ride they took without worrying about having exact changes.

Faster and more efficient transactions

Getting a card from the wallet, entering it in the software, verifying the OTP, and then making the payment. It's a time-consuming and slow payment process.

When you have an in-app wallet in your ride-hailing system, it enables you to offer speedy and efficient payment options to your passengers.

You can offer the same by having an in-app wallet in your white-label app. It also serves as a customer retention strategy which helps you reward your loyal passengers for their continued engagement with your ride-hailing service.

Promotions and loyalty programs

Uber and Ola have an in-app wallet in their ride-hailing solution. Using this feature, they can offer incentives such as cashback, discounts, and loyalty points. This encourages your customers to use your payment system more than others.

You can offer the same by having an in-app wallet in your white-label app. It also serves as a customer retention strategy which helps you reward your loyal passengers for their continued engagement with your ride-hailing service.

Security and fraud prevention

Tokenization and storing facility is what in-app wallet offers. The taxi dispatch software with an in-app wallet in it, allows your users to store their payment credentials.

It establishes another security parameter and reduces the exposure of sensitive payment information. It ensures robust security measures to prevent fraud in digital transactions.

For instance, by integrating an in-app wallet in your white-label software, you can provide a secure method for your passengers to make safe transactions, and safeguard your passengers from potential fraudulent activities.

Global expansion and payment options

Tying an in-app wallet to your vehicle dispatch software allows you to expand into new regions quickly. You can set a standardized payment method for global reach and offer your passengers their familiar payment option.

No matter what country you offer your service, the in-app wallet allows you to offer payment flexibility to your customers and helps you remain compatible. For example, with Google Pay, Stripe, PayPal, etc. payment options, you can offer the convenience to smooth payments to your customer.

Having the in-app wallet in your software allows your users worldwide to seamlessly access and utilize your ride-hailing service easily, regardless of their payment methods.

Reduced dependency on cash

Handling cash can bring your drivers to robbery risks and make tracing transactions difficult.

With an in-app wallet in your on-demand ride-hailing software solution, you can encourage a cashless environment for both your drivers and customers and reduce cash dependency.

You can allow your customers to pay online right from your ride-hailing app. Passengers do not have to carry cash nor does your driver have to think about managing cash or giving a chance to meet the exact trip amount like $35.60 and return the rest from the $40.

It will result in safer and more traceable transactions. This not only enhances your user safety and driver security but also promotes the overall transition toward cashless transactions in the ride-hailing ecosystem.

Transaction history and management

In-app wallets offer you, your drivers, and your customers a user-friendly transaction tracking feature. It aids in budgeting and expense management. Your passengers can log in to your ride-hailing software and easily monitor their spending and manage their ride-related finances efficiently.

Moreover, an in-app wallet brings more clarity to your financial health of operations by making your verification, auditing, and reporting easy.

So, you now have discovered the role of a taxi wallet application in ride-hailing. And you know how important it is to grow your ride-hailing business. It's not just making the payment method, but also a core feature in your business growth.

Let us now see the difference you will see in your business with and without an in-app wallet in managing your business with your ride-haling software.

Comparison of ride-hailing with and without in-app wallet

Here is a comparison table for you to easily with advantages and disadvantages of an in-app wallet in ride-hailing to easily understand what business benefit you get with it.

| Category | Without In-app Wallet | With In-app Wallet |

|---|---|---|

| Payments | Your driver handles cash and cards manually | Allows your customer to make payment in one click |

| Transaction times | Often exceed 60+ seconds | The transaction gets completed in 5 seconds |

| Promotions capability | Limited | You can offer personalized discounts and loyalty programs |

| Fraud risk | Higher exposure | Enhanced security protections |

| Fees | High credit card processing fees | Lower digital transaction fees |

| Revenue tracking | Hard to track revenue and even individual ride payments | Data is generated automatically which allows you to track revenue with ease |

| Customer convenience | Requesting cash, waiting for change, or repeating card details irritate your customers | With pre-saved details, your customer can pay with a single click. It ensures a seamless cashless experience |

| Operational insights | You get minimal visibility into your finances | Robust real-time reporting and analytics |

| Competitive standing | Falls behind with features your rivals offer in the market | Gives you a key differentiation based on experience |

| Global expansion | Integrating various regional bank rails and foreign payment types makes it difficult for you to scale | You can easily integrate diverse payment methods and still keep the interface unified. It makes it easy for you to scale globally |

| Future technology enablement | The foundation is constrained. It is complex and expensive to adopt new technology | The foundation is created with a vision to connect emerging technology |

An in-app wallet helps you to optimize your costs, security, automation, and the end-user experience. This unique capability sets you apart from your competition.

Going “without” will cause you to lose customers and profit whereas “with” will help you achieve your business goals.

Here is one of the leading ride-hailing software that carries a bunch of advantages.

Benefits of Yelowsoft in-app wallet

-

Customizable platform - You can easily tailor special offers and payment rules to meet your unique business goals.

-

Omnichannel wallet - Understand your customer behaviors across all interactions to boost loyalty.

-

Security protections - Safeguard the sensitive data of your passengers to prevent fraud and increase trust.

-

Operations analysis - Get access to the analytics feature and use it to optimize your financial decisions.

-

Digital receipts - Eliminate paper receipt hassles. Replace it with digital receipts, generate in seconds, and save your drivers time.

-

Loyalty programs - Reward your regular and loyal customers by driving engagement with customized promotions and perks.

-

Lifetime value - Deliver value to your customers and drive long-term profit with Increased repeated trip requests.

-

Subscriptions - Create flexible recurring payment packages to retain users.

-

Performance tracking - You can keep track of your business KPIs, have a 60-degree overview of your business, analyze the data, and make a data-driven strategy. Use this strategy to make result-driven decisions and convert them into increased numbers of customers and profits.

Conclusion

Here’s the bottom line. Passengers want flexibility, and offering a variety of payment methods caters to that demand perfectly. It builds trust, removes payment friction, and gives users confidence that your service fits into their lifestyle, no matter how they choose to pay.

For taxi businesses, it’s not confusion, it’s conversion. The more ways you offer your customers to make payments, the more reasons they have to ride with you again.

FAQ's

Taxi companies need mobile apps because it helps them to keep pace with other ride-hailing service providers. It also works in evolving consumer preferences for on-demand transportation. The cloud-based taxi dispatch software automates business management, allows online booking, enables tracking, generates accurate fares in real time and more. This helps in elevating customer experience while optimizing operations.

Integrated mobile wallets are necessary in taxi apps because they enable one-click payments for the passenger within the taxi app itself. This eliminates the friction of cards or cash which irritates riders. This convenience combined with perks like promotions and loyalty programs in the cab booking app increases customer retention and satisfaction.

Yes! It is important to integrate payment gateways in taxi apps because payment gateways provide all the capabilities of a point-of-sale without expensive hardware. Drivers can collect fares quickly through mobile devices while the admin gets complete transaction insights. This integration in the taxi booking app plays a vital role in streaming operations.

A loyalty program is significant in retaining customers. It encourages repeat business by rewarding frequent customers with perks like discounts on future rides. This activity cultivates higher customer lifetime value.